The Problem

Africa has a growing number of innovative businesses and startups turning Africa’s most difficult challenges into some of the biggest business opportunities. Unfortunately, small & medium African enterprises have few places to turn to fund their businesses, and investors have a difficult time assessing African companies. African startups generally receive a disproportionately smaller share of institutional investments compared to other developing regions. Additionally, the impact on economic growth of the foreign direct investment the continent attracts is lower than other comparable parts of the world.

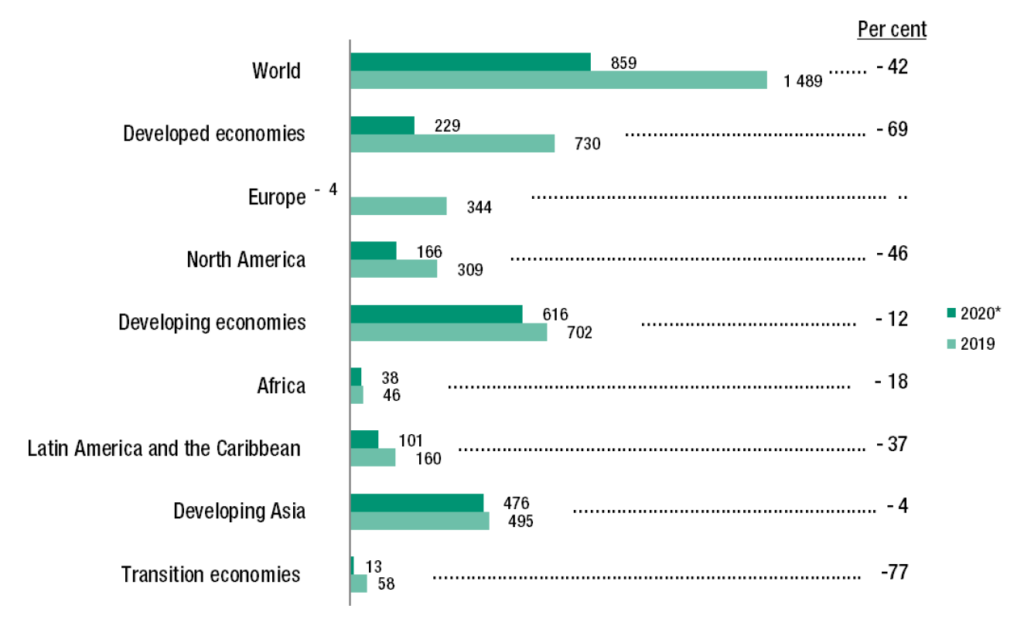

FDI inflows by region, 2019 and 2020 (billions of US dollars)

Source: UNCTAD (preliminary estimates)

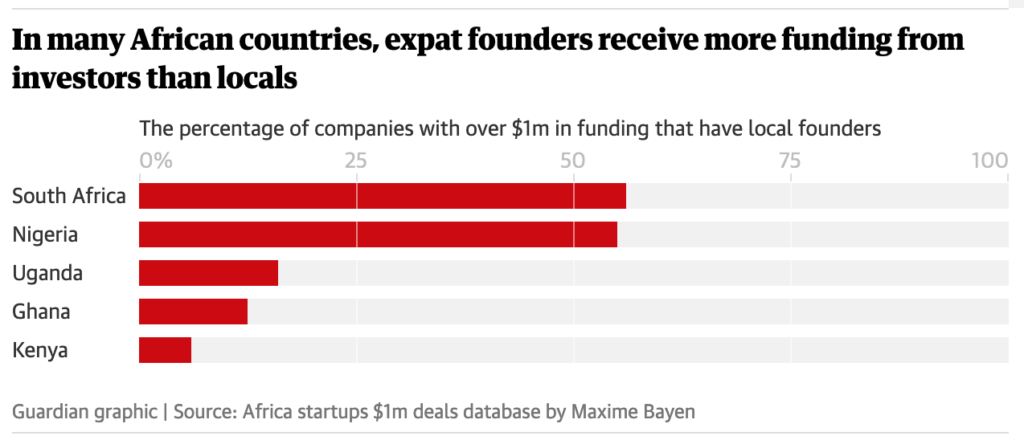

To add insult to injury, the majority of the foreign-sourced funding that makes it to Africa goes to expatriate founders from Europe, United States or China rather than local African founders.

Our Ambition

We dare imagine a self-sustainable African entrepreneurial ecosystem where its capital needs are met from within and its economic value mostly benefits Africa and all Africans.

That is why we built the AfriCrowd; to empower African innovators and Africans in diaspora to tackle Africa's market gaps while creating long-term wealth for Africans by providing a safe, secure, and trusted platform for financial and human capital collaboration.

Our Approach

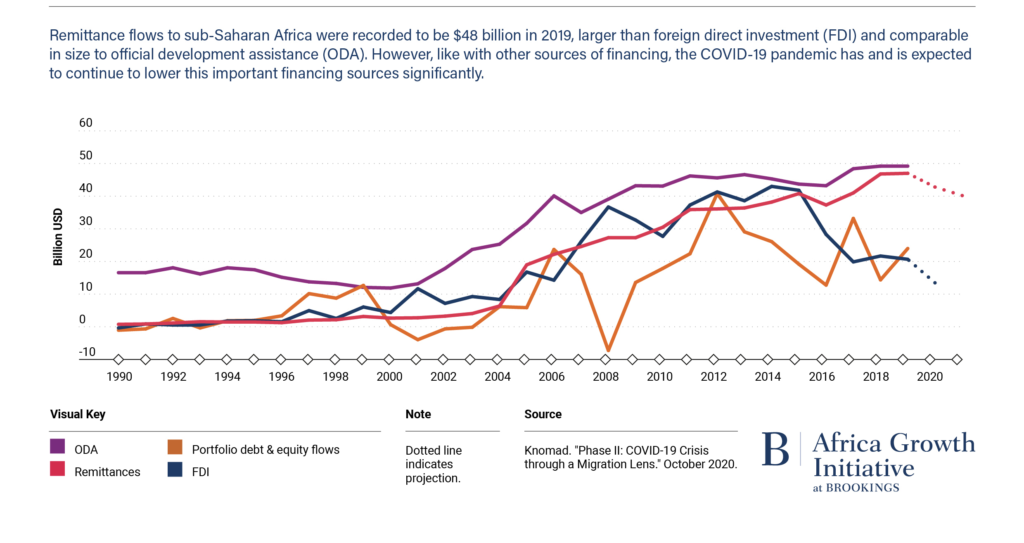

Africans living abroad are sending nearly US$80 billion each year to families back home. We believe that if some of that money is channeled into the formal investment pipeline, the African diaspora could significantly help innovative African entrepreneurs solve Africa’s market gaps, alleviate Africa’s dependency on foreign debt, while at the same time helping retain Africa’s wealth in Africa.

Why Africa? Why Now?

Africa is the next frontier.

1. Africa’s economic growth prospects are among the world’s brightest.

- Africa’s abundance of natural resources presents a huge opportunity for developing value chains.

- Africa is industrializing and urbanizing fast.

- With the African population becoming the youngest in the world (median age 18 years old) combined with a steady rise of the middle class, Africa's purchasing power and workforce is poised to compete with those of China and India in the very near future.

- Over the past 15 years, the economies of at least 6 African countries have outperformed Latin America and developed countries.

- Africa's private sector is getting stronger and vibrant, shifting the conversation about African from one of “deficits” and “gaps” to one about opportunities, prospects, ventures and creativity.

- More African policymakers are now committing to building an environment conducive to investment in terms of trade, regulation, political and revenue systems on a national, regional and continental level. Although not perfect (yet), the African Continental Free Trade Area that commenced in January this year is a testimony.

The Tiger and the Dragon have had their days, and now the Lion is roaring.

2. Africa is (finally) addressing the obstacles

- Africa is turning the long-talked-about African infrastructure deficit into opportunities for investors.

- More African governments are committing to the economic transformation agenda.

- For the last 2 decades, Africa has been diversifying beyond commodities and building new value chains based on telecommunications, agritech and energy.

Why Engage Africans In Diaspora?

Many Africans In Diaspora have important skills and experiences that could fill capacity gaps in Africa if appropriate engagement modalities were in place.

African Diaspora Direct Investment (AfDDI) capacity can alleviate Africa’s dependency on foreign debt, if not replace both Foreign Direct Investment (FDI) and Official Development Assistance (ODI) as the biggest driver of growth in Africa.

FDI inflows by region, 2019 and 2020 (billions of US dollars)

African Diaspora Direct Investment (AfDDI) could be better source of capital for African startups and early-stage companies than foreign-based sources for the following reasons:

- Value-Rich: In addition to financial capital, Africans in Diaspora can provide access to developed markets, access to more efficient technology, and improved business practices. They can also provide skills training, networking, and mentoring, and skilled human capital in the form of advisors and evangelists to outside markets.

- More Stable: Because diaspora investors have some degree of cultural affinities and market knowledge, they are less averse to the risk associated with both political and economic shocks than foreign investors.

- Less Costly: Diaspora investors are already familiar with the local environment, which helps reduce transaction costs of new entry and building new partnerships. Also, their local social connection and networks are good enablers of trust and contract enforcement.

Challenges We Solve

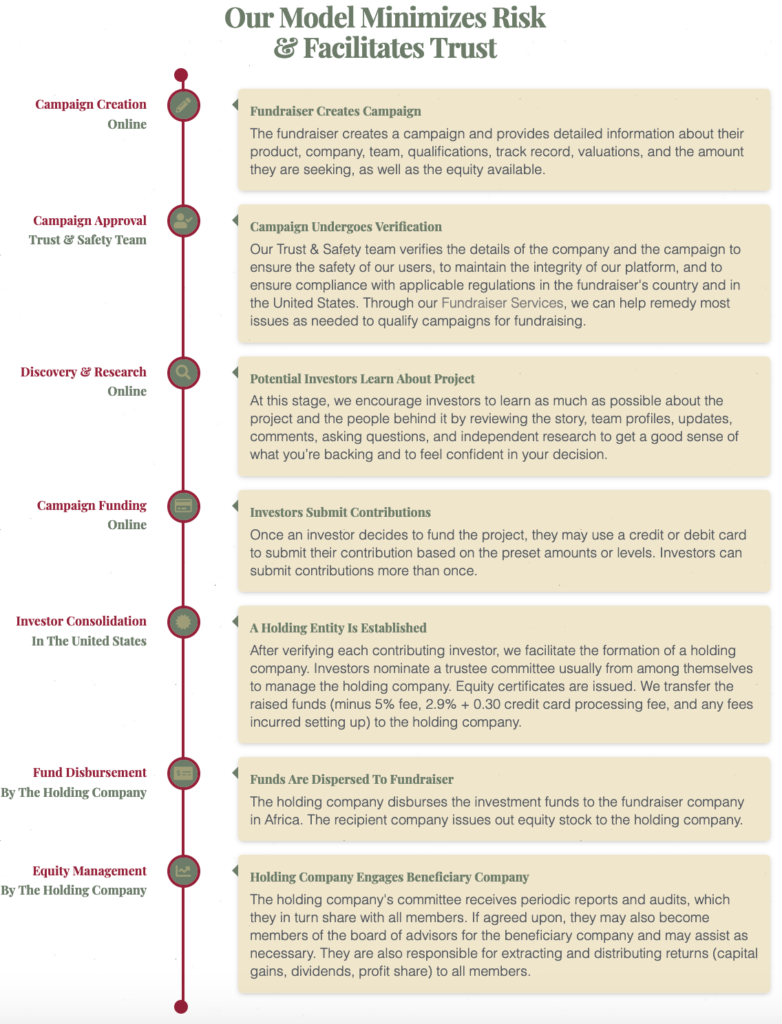

Investing in early-stage businesses and startups can be very rewarding but comes with its risks and challenges, particularly in Africa. These risks include equity dilution, liquidity issues, loss of investment, and rarity of dividends. This is one of the biggest causes of non-Africa-based investors’ hesitancy to investing in Africa. We designed our platform to address and minimize some of those challenges.

- Capital gains or profit repatriation

*See the FAQs sections for more details.

Our Achievements So Far

Our efforts so far have centered around building the platform and putting it to test by mobilizing our targeted users.

And so far, AfriCrowd is receiving immense support from both investors and founders.

During our closed initial investor mobilization, we registered commitments nearly US$2 million (and growing each day) in just 30 days. We expect that to grow to no less than US$25 million by the end of 2021.

On the founders side of the model, we are currently onboarding startups for our early-access program (invite only). Within the first week of the program, we registered over 20 companies of all sizes with a market value of over US$40 million.

What's So Special About Us

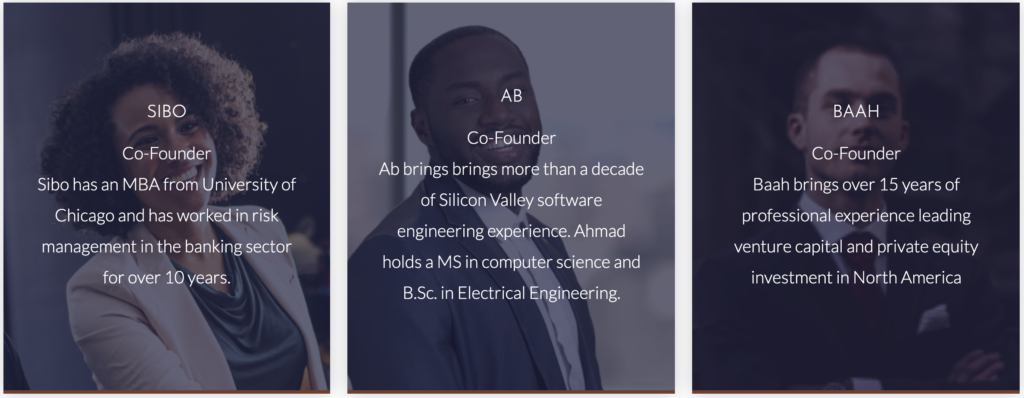

Our Team

AfriCrowd is backed by a stellar team of individuals with experiences in venture capital, startup ecosystem, and technology from across the world. In addition, all of our team members have a passion for Africa. It is this experience combined with a strong connection to Africa that gives us unique insight into the African startups and investment landscape.

Our Network

AfriCrowd is launching alongside a sister company; AfriCap, a VC firm focused on the African startup ecosystem. Together with other partner VCs and angels, AfriCap is geared to engage exciting investment opportunities coming through the AfriCrowd platform through syndicates. Such a network exposes African founders to a strong community of angel investors, venture capital, advisors and talented professionals who would support them as they grow.

Where We Are Headed?

Phase 1: Accelerate investor adoptions through closed (invite only) pledges.

Phase 2: Accelerate startup adoptions through closed (invite only) early-stage access program. Selected startups will be featured in Phase 3.

Phase 3: Increase platform awareness via aggressive marketing targeting both startups/early-stage companies and potential investors via social media, search media, rounded off with PR campaigns. Selected campaigns from Phase 2 will be featured in our marketing campaign.

Other Ways You Can Support Us

You can help our project in multiple other ways. One of the best ways to help us is by sharing our website to your network individuals and institutions in alike who will be interested in our cause and want to support us.

You may follow us on Twitter, Facebook and Instagram.

If you would like to support us in other ways than these, we are open to ideas and would love to hear more about them. Please contact us here.

*Disclaimer: some information contained herein are for demonstration purposes only.

Updates

Pitch FAQ

1. What is crowd funding?

Equity Crowdfunding enables the general public to fund start-up companies and small businesses in return for equity. In simple terms, people give money to a business and receive a share of ownership of that business. If the business succeeds and its value goes up or is sold, such investors get a share of the profits or capital gains.

2. How do we solve problems associated with crowd investing in Africa?

- Crowdfunding Regulations: Our model enables each funded project to receive the raised funds as an investment from a single source; therefore removing or limiting any regulatory complications that would normally arise regarding crowdfunding in the beneficiary country.

3. Who may raise funds on AfriCrowd?

Although each project is qualified on an individual basis, we generally accept African businesses that at least have a tested prototype or service model and have developed a business plan. Usually, such businesses funding stage ranges from Seed to Early-Stage (soft Series A).

4. Raised funds can be used for what purpose?

Funding for any of the following activities:

- Development of a product for market

- Launch product

- Develop a market abroad

- Build traction until revenue starts to come in.

- Capacity building such as recruiting

5. How much capital can I raise through AfriCrowd?

Funding goals can range from as low as USD $10,000 to $5 million.